Point of sale Free payment solution

Never pay EFTPOS fees again. Switch to fee-free EFTPOS.

Keep Every Dollar Of Your Sale With OPT $0 Cost EFTPOS

By applying a minimal surcharge, we can wipe out your transaction fees! Plus, pay no terminal rental if your monthly turnover is over $10K in monthly card transactions. Who doesn’t love savings?

- Fee-Free EFTPOS

No terminal rental and no transaction fees

- Get paid in full, fast

Speedy settlement to your chosen bank account

- We’re available 24/7

Need help with your EFTPOS at 2am Our experts are here you 24/7

- Simple set-up

Quick application process. Easy plug-and-play set-up

OPT $0 Cost EFTPOS Includes:

- Unlimited fee-free transactions

- No lock-in contracts

- Calculate the right surcharge automatically – no admin or guesswork

- Customise when to apply a surcharge, and for what cards

- Portable EFTPOS terminal that connects through 4G, Wi-Fi or Broadband

- Settlement to your chosen business bank account the next business day

How It Works

01Get Your New OPT EFTPOS Machine

Get your new machine for $0. Available if you turnover more than $10,000 in EFTPOS transactions per month.

02Automatic Surcharging

With automated surcharging, let your terminal do the math. No finger-counting needed! Surcharging enabled means you pay nothing!

03Reinvest & Grow

You’re saving! High-five your business with a cashflow boost.

04Support That Never Sleeps

Our team is ready to lend a hand whenever you need it, 24/7.

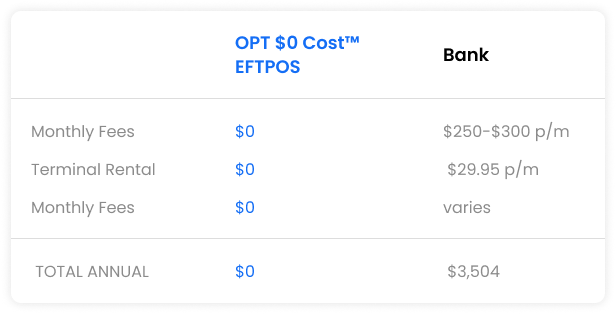

How Much Could You Save With OPT $0 Cost EFTPOS?

Picture this – let’s say you’re a business that’s hitting a busy period, and when sales go up, so do your EFTPOS fees. But that’s not the way with OPT $0 Cost EFTPOS. Your costs are fixed at zero, even when sales are running hot. How good is that!

Check Out Why These Businesses Made The Switch To Smartpay Fee-Free EFTPOS

Our customers are happy to save on EFTPOS fees and experience Smartpay’s best-in-class service. Don’t just take our word for it – here’s what they have to say.

Beautiful EFTPOS Savings for Bare Beauty House

Smartpay Saves Vet from EFTPOS Fees

A Change In EFTPOS Provider And New Terminal Makes For A Stylish Hair Salon

Discovering the Beauty of Savings With Smartpay Zero Cost™ EFTPOS

We’re Great at What We Do

Best for Value

Merchant Terminals

2024

Best for Flexibility

Merchant Terminals

2024

Get Quick Answers to Your Concerns

write to us at

Our EFTPOS terminal connects via a complimentary 4G SIM card (provided by OPT), Wi-Fi, or Broadband. It supports additional features such as Tap ‘n’ Go, tipping, MOTO (Mail Order/Telephone Order), and surcharge add-ons.

Any business with an average monthly card transaction turnover exceeding $10,000 can apply for OPT Zero Cost EFTPOS. If your monthly turnover falls below this threshold, you’ll incur a terminal rental fee of $34.95 + GST, but there will be no transaction fees.

We waive the $90 + GST setup fee when you join. You will only be charged this fee if you cancel within the first 12 months.

Many of our clients find that their customers accept a small surcharge. Surcharges have become common in industries such as bars, cafes, restaurants, automotive services, and professional services. We provide clear countertop signage with each terminal to ensure your customers are fully informed about the surcharge before completing their payment. The terminal also displays the surcharge amount separately when the customer confirms the total.

If a customer prefers not to pay the surcharge on a specific transaction, you have the option to absorb the surcharge by bypassing it on the terminal.

With OPT Zero Cost EFTPOS, you can accept EFTPOS, debit, Visa, and Mastercard. If you have an AMEX merchant ID, you can also process AMEX payments, although AMEX will still charge fees for those transactions.

No need to worry! OPT Zero Cost EFTPOS simplifies everything, so there’s no administrative work or manual calculations required on your part.

If you choose to handle your own surcharge, you'll need to:

- Calculate an acceptable surcharge that complies with the RBA’s standards, ensuring it doesn’t exceed the cost of accepting payments, or risk facing penalties.

- Continue paying transaction fees each month, and manage those fees to make sure your surcharge covers them.

- Spend extra time separating surcharge payments from your sales for accounting purposes.

With OPT Zero Cost EFTPOS, all this admin work is handled for you! However, if you prefer to control the surcharge yourself, we offer that option through our Simple Flat Rate add-on.

No worries—there’s no penalty for increased sales! In fact, the more you earn, the more you save on merchant fees.

No, OPT Zero Cost EFTPOS has no minimum contract term. If you cancel before 12 months, you’ll only need to pay the setup fee that was initially waived ($90 + GST).

Your funds are settled into your account the next business day. Monday through Thursday transactions are settled the following day, while Friday through Sunday transactions are settled on Monday. Availability depends on your bank's processing times.

You can choose any Australian business bank account for your settlements—there's no need to change your current bank.

No, there’s no terminal rental fee if you process $10,000 or more in card transactions within the month. If you don't meet this threshold, you’ll pay $34.95 (plus GST) per terminal for that month.

After your application is approved, your terminal will typically arrive within 5–9 business days.

Yes, paper rolls are charged at a low cost, with a fixed-rate delivery fee. You can conveniently order them online.

You’ll have access to our 24/7 technical support team. If your issue can’t be resolved over the phone, we’ll send you a replacement terminal at no extra cost.

No, your OPT terminal will automatically receive free security and software updates throughout the duration of your lease.

write to us at

Ready to say goodbye to EFTPOS bills?

Get OPT $0 Cost™ EFTPOS Today.

Every month our Payment Specialists help thousands of businesses just like yours get the right payment solution. Let’s chat about your business today.

Contact Sales on 1800 685 052